The global industrial landscape has been dramatically reshaped in the last two decades. Emerging technologies and their integration into complex technology systems are redefining value creation, especially so in manufacturing production1. In particular, the increase of automation, robotics and digital technologies in applications—coupled with new developments in both nano- and bio-technologies—is altering manufacturing processes and production technologies, increasingly blurring the boundaries between physical and digital production systems. This is the so-called ‘4th Industrial Revolution’ (4IR).

Some scholars emphasize that the digital technologies unlock opportunities for developing countries to leapfrog from their relatively underdeveloped production structures straight into the 4IR2. Others swing to the other extreme, arguing that the problems associated with the development and application of these technologies call the feasibility and desirability of manufacturing-led development into question3.

In our recent article4, we take the middle ground and assert that manufacturing continues to be pivotal for economic development, but that developing countries face considerable challenges if they are to actually take advantage of the transformations generated by the 4IR. Countries that seek to benefit from the 4IR will not be able to simply ‘leap’ into it, i.e. move from Industry 1.0 or 2.0 straight into Industry 4.0. A gradual process of learning, developing and accumulating foundational capabilities is necessary to truly benefit from the opportunities the 4IR can unlock.5

The 4IR is not as revolutionary as people think

In the global debate on 4IR, its technologies are presented as being radically new, disruptive and as breaking with the past. Although it is true that many of these technologies have an important impact on production, employment, the nature of work, healthcare, education and on many other aspects of our daily lives, there does not seem to be much discontinuity with previous technologies when we take a closer look at their knowledge base.

Neural networks (the basis for Artificial Intelligence or AI) were initially developed in 1943, modern biotechnology has been developed since the 1970s, and even data usage and computing power does not per se seem to represent a rupture with the past. The best example of this is the famous Moore’s Law,6 a prediction made in 1965, which to this day has kept much of its explicative power. The recent developments thus seem to be a continuation of these trends rather than a major discontinuity thereof.

The main point here is that we need to distinguish between a technology’s effects and its knowledge base – the latter being what matters when speaking about learning and capabilities development.

‘Technology fusion’ and the need to develop ‘foundational capabilities’

What is truly new about the 4IR is not the individual technologies it is composed of, but rather the fact that they are increasingly being ‘fused’ together in complex integrated technology systems and are finding increasing transversal areas of application. This ‘technology fusion’ is what creates the more disruptive dynamics.

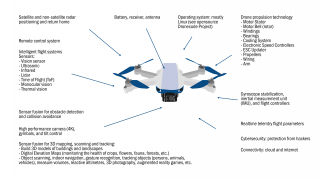

Combining different technologies is not a new phenomenon, of course. However, it seems that in the 4IR context, systems are reaching a new level of complexity and interdependency between traditionally separate and specialized fields of knowledge. As an example, the figure below shows the wide array of technologies from different knowledge areas fused into a single quadcopter drone.

The development and application of this increasingly high level of technology fusion requires interactions between many different actors, making the building of ‘ecosystems’ of actors who work in networks (instead of chains), largely within a unifying digital platform, increasingly important.

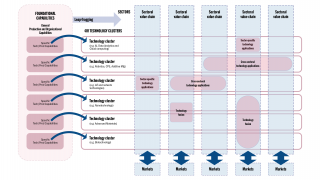

Technology fusion also highlights the importance of developing capabilities in various technology domains which, as already noted, are not radically new. Thus, what seems crucial is not the development of specific technological and production capabilities, but of ‘foundational capabilities’, which we define as capabilities to acquire knowledge about new technical and organizational solutions, to learn how to integrate them into production, and to organize and commit resources over time for the effective deployment of these new solutions. The figure below summarizes our digital industrialization framework.

Opportunities for leapfrogging

Once these foundational capabilities are in place, several opportunities for leapfrogging open up across sectors.7 Despite many sectoral differences, we find commonalities of the impact of technology fusion across four dimensions.

R&D, design, pre-manufacturing innovations

Virtualization of the product development stage by using virtual/augmented reality technologies or enhanced modelling and experimentation processes using AI and big data analytics. This can improve prospection activities in extractive industries and speed up the certification of new drugs and chemicals, as well as new vehicle components and systems. 3D printing furthermore enables much faster prototyping, thereby accelerating product development and time-to-market.

Process innovations

Smart and connected production, and refers to the widespread use of sensors and actuators (Internet of Things), AI, cloud computing, advanced and collaborative robotics, cyber-physical systems and additive manufacturing, with network technologies sewing them together. This enables predictive maintenance of equipment and systems, lower energy and material use, enhanced tracking and monitoring of processes, improved process control (temperature, vibrations, deformations, etc.), enhanced quality control, higher yields in chemical processes, and many other applications.

Product innovations

Smart and connected products, i.e. products with embedded connectivity and analytics functions, from smart wearables (clothes, watches, glasses) to smart household appliances, and smart and connected vehicles (cars, aircrafts, drones, tractors, etc.). Such products require not only digital technologies but often also nanotechnology solutions and advanced materials. Another general trend is the development of highly customized products, ranging from 3D printed clothes to the highly customized drugs of the ‘precision medicine’ model based on advanced biotechnology. New bioprocesses, which are intensive in computing and data analytics, are also creating new products in the chemical, pharmaceutical, food and basic inputs industries.

Supply-chain management and business model innovations

One key factor here is enhanced capacity to track and monitor products both upstream and downstream. This can lead to better stock management and to the next step in the just-in-time paradigm, as 4IR technologies enable real-time demand monitoring. Product monitoring continues after sale, creating opportunities for complementary services, and intensifies the process of blending between manufacturing and services (also known as servitization of manufacturing). 4IR technologies further enable processes of disintermediation, especially with the rise of digital platforms of commercialization, where customers can access multiple suppliers (and suppliers have access to multiple buyers). Finally, decision making can be significantly improved in most sectors with the use of insights originating from business-related data analytics.

Policy implications

To benefit from the 4IR, developing countries need to develop their foundational capabilities. As discussed in depth by the technological capability literature8, this involves a mix of skills development, engaging with production, active industrial policies, and the development of supporting institutions.

Numerous opportunities are unlocked once a certain level of capabilities is reached – not only in high-tech sectors, but also in sectors common in developing countries, such as farming and agroindustry, extractive industries, and textiles and apparel. Strategic policies are crucial to effectively take advantage of the new opportunities associated with the 4IR.

Recognizing the roles of different sectors in the 4IR is crucial. Some sectors push (or supply) 4IR technologies, such as information and communication technologies and capital goods, while others pull (or demand) such technologies, such as consumer goods, basic inputs, pharmaceuticals and agriculture.

Policies aimed at facilitating the creation of ecosystems, bringing together traditionally separated actors, are needed in push sectors to adequately absorb and develop the knowledge base of 4IR technologies. Pull sectors require technological diffusion policies aimed at reducing both the costs associated with the adoption of 4IR technologies and the uncertainty associated with new technology investments. Widespread adoption of such technologies will guarantee demand for push sectors, and the interaction between the push and pull sectors will generate sector-specific incremental innovations which, if properly incentivized, can lead to the emergence of specialized players adapted to local needs.

Indeed, the capability challenges that developing countries face in their quest for industrialization in the age of 4IR are daunting, and much of the productivity growth and value addition gains from 4IR technologies can only be achieved by engaging in specific production processes and activities. Consequently, industrial policy in the twenty-first century will have to be more grounded in the reality of digital production technologies, smarter in climbing the technology ladder, and more agile in selecting opportunities than has typically been the case in developing countries.

Disclaimer: The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).

Have your say

What is your opinion on the IAP?